This post is designed to report on and explain the new Speculation Tax brought in by the BC NDP Government as part of their first budget under Premier John Horgan's leadership.

I, personally, don’t have a hot take on this and simply believe this government has done their best to address some very real and difficult forces at play within our marketplace. Is it perfect, no, but could it be, no. I like to try and break things down to simplify and understand them best so here it goes..

As defined by the government in a statement revised in March 2018 speculation is “when a property owner holds onto vacant homes and benefits from rising property value”. From the same report this must be addressed because “speculation has contributed to runaway prices and made it difficult for British Columbians to find a home they can afford.”

What is speculation and why need it be addressed?

As defined by the government in a statement revised in March 2018 speculation is “when a property owner holds onto vacant homes and benefits from rising property value”. From the same report this must be addressed because “speculation has contributed to runaway prices and made it difficult for British Columbians to find a home they can afford.”

What are the government's goals and what results is it the provincial governments intention to effect by implementing a Speculation Tax?

- To ensure British Columbians can live in their own province

- To push speculators out of the market

- Help turn vacant and underutilized properties back into homes

- Increase the supply of available housing in designated urban centres

Who is liable to pay the tax?

Foreign Investors. I understand this to be any non-canadian citizens and those who do not live or report any income in British Columbia.

Satellite Families. Government describes a satellite family as those “households with high worldwide income that pay little income tax in B.C.”. I’ll be interested to hear of the mechanics/logistics of determining this.

Owners of multiple properties deemed “Domestic Speculators”. This will exclude anyone renting their property for more than 3 months in 2018.

In 2019 and beyond this will exclude anyone renting their property for greater than 6 months in the year for segments no less than 30 days.

How much is the tax?

For this year, 2018, the tax will be charged at 0.5% of the properties value. The report does not state how the properties value will be determined. I would speculate however ( ?see what I did there) that they will use the properties assessed value but does appear they are leaving open the option to use the fair market value (sale price) should the property have been purchased within the year applicable.

For the year 2019 and beyond the tax will be levied at the following rates:

- 2% for “Foreign Investors” or “Satellite Families”

- 1% for Canadian citizens and permanent residents who do not live in British Columbia

- 0.5% for British Columbians who are Canadian citizens or permanent residents.

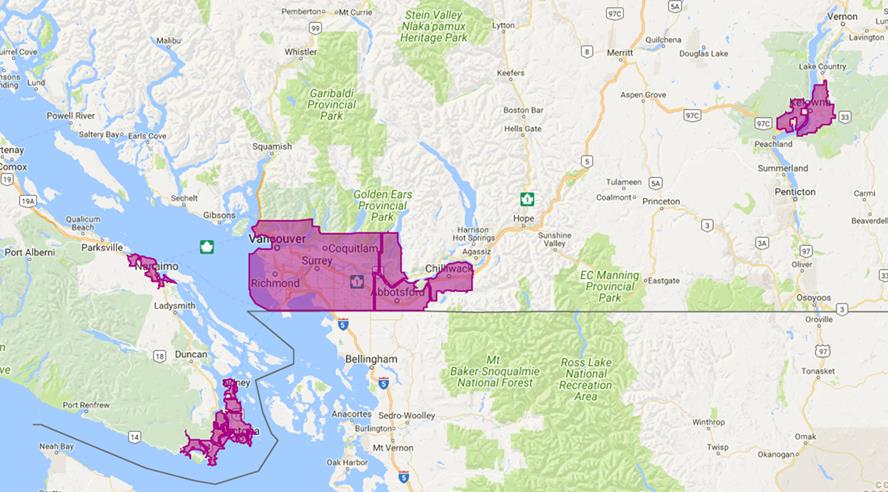

Where in the province is the Speculation Tax applicable?

- Metro Vancouver Regional District, excluding:

- Bowen Island

- Electoral Area A except the area of UBC Endowment Lands

- The Capital Region, excluding:

- Gulf Islands and Juan De Fuca

- Kelowna

- Nanaimo-Lanztville

- Abbotsford

- Chilliwack

- Mission

What if..? Wait.. There are exemptions and credits to the speculation tax..

- It is your primary residence

- Property is within the long-term rental pool (Note above differences in ‘18/’19)

- If the property is vacant due to health of the homeowner as they reside in hospital, long-term or palliative care.

- If the property is vacant due to the homeowners being away for work/business purposes

- If the homeowner is deceased and the estate is in process of being administered.

You will receive an immediate $2,000 credit for the tax if:

You are a canadian citizen or permanent resident that is not part of a "satellite family". The credit will only be eligible on one property.

The amount of this credit is precisely 0.5% of $400,000. The credit was designed to be this amount likely as the result of feedback the government received in regard to how this tax would affect vacation homes of Canadians.

Here are some scenarios and the resulting tax applicable as I understand it:

I am the owner of a Downtown Vancouver condo with an assessed value of $737,500 that I have recently received a Short-term Rental Business license for to AirBnB.

A: Well, in this case you are required to be the primary resident so you are exempt.

I am a Canadian Citizen and the owner of a Kitsilano condo valued at $670,000. I live out of province 8 months a year and leave the condo vacant during that time.

A: You will be liable to pay 0.5% of the properties value less the applicable credit of $2,000. Therefor you pay $1,350 in speculation tax.

I am a Foreign Investor with an interest in Vancouver Real Estate. I own a Olympic Village condo valued at $875,400.

A: If you rent this property out on a long-term lease you will be exempt from the tax. However, if you do not rent the property, even if you’re occupying the property yourself, you will be liable to pay the speculation tax. This would be levied at 0.5% of the properties value in 2018 and 2% of the properties value in 2019 and beyond. This would amount to $4,377 for 2018 and $17,508 in speculation taxes for 2019.

Comments:

Post Your Comment: